How Important Is Budgetary Controls To Your Business?

In business, one of the question people ask is – Do we have to do a budget?

then the question is – how important is budget to a business?

if we were to go into more details, you may come across the term budgetary controls.

So, what is a budget?

For a business, a budget is a plan to estimate the revenue and expenditure of the business for a period, normally it is over a period of twelve months, it covers the financial period of the business.

On personal level, a budget is a tool people used to control their expenses

We can notice the different between a company having a budget and one without any budget prepared.

For a company having a yearly budget, the company looks more organized and structured whereas one without any budget, will be like swimming in an ocean without any direction.

How important is budgetary controls to a business?

We have seen earlier that a company without a budget is like operating a business without any direction. It is more ad hoc than anything else.

Without a budget, is tantamount to without any planning.

Simple meaning of budgetary controls

Budgetary control is the mechanism of comparison the budgeted amounts against the actual performance of the operation.

The budgeted amount is the forecast of the revenue and expenditure of an organization based on past performance and the market conditions and current business environment.

It is a process of business planning involving financial planning, business plan and setting of business goals and so on. I will have a separate discussion on how to prepare a business plan HERE.

If budgetary control is implemented effectively and properly, it can be a very powerful tool for a business to monitor its operation, at the same time, achieving the goals set, not to mention to make the business more efficient and productive.

What are the advantages and disadvantages of budgetary control?

Advantages

1. Acted as a tool to assess performance of respective departments and divisions in a company.

2. Setting of reduction of cost as priority.

3. It helps to improve efficiency and productivity.

4. Improve discipline of staffs in valuing how they spend the company money.

5. It can be used a benchmark for appraising the performance of staffs.

6. Serve as a guide in assisting the company to achieve its long term goals.

7. Enable the company to compare the forecast ed expenses and the actual spending and make necessary adjustment.

Disadvantages

1. Information used in the budget is very subjective and may not be realistic.

2. Preparing a good budget is a long and tedious process

3. Inter departments coordination is challenging especially between operation and finance.

4. Comparison of actual and budget may be a problem when there is an adverse variant, it may demoralize the department concerned.

5. Reasonableness and realistic of the budget figures may be challenged by department if it is not to their favor.

6. Top management needs to give approval for the budget, if the approval is not given promptly, it defeats the purpose of comparison of budget and actual.

What are the limitations of budgetary control?

1. As we know, budget is based on historical cost, hence its accuracy and reasonableness are very subjective.

2. In a volatile economy environment, budget figures may look awkward and not realistic at all.

3. Changes in government policies and taxes structure may affect the budget.

4. Changes in nature such as natural disaster, market condition may affect the comparison between budget and actual.

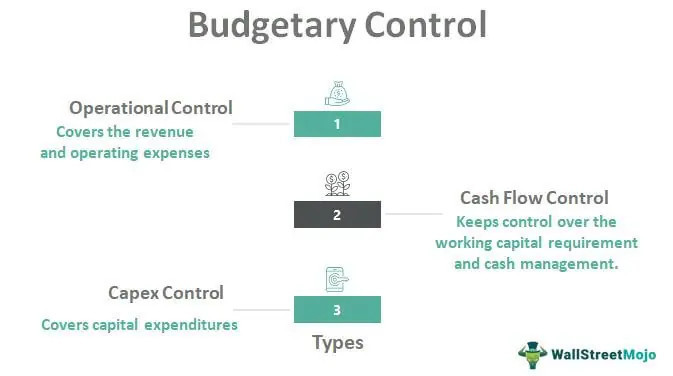

What can you do with budgetary controls ?

1. We can use this to control the cash flow.

2. Operational controls.

3. Cost analysis for the business

1. Using budgetary control to monitor the cash flow.

budgeted cash flow forecast is another form of budgetary control.

with a proper cash flow forecast, we can monitor the cash flow when we compare the forecast and the actual.

2. Operational controls

by having a good budgetary control, we are able to identify the weakness and highlight the needs to take rectification action.

When the analytical review is done to compare the actual against the budget, we are able to identify the area need more attention.

At the same time, we can also use the analysis to implement better control.

3. Cost analysis of the business.

Budgetary control enables us to find out areas which need to be controlled.

using budgetary control, and from the analysis, we are able to find out which sectors’ costs are not in the norm of the business operation.

We can then take necessary action to arrest the worsening situation.

Conclusion.

Budget is a plan devised to help a business operate in a more orderly and systematic manner.

It is a yardstick for a business to measure performance and improve efficiency.

By having a good budget and using it as budgetary control, a business will be able to have a good business plan which cover all spectrum of the business.

With a good business plan, a business is able to improve and grow according to plan.

Therefore, let us prepare a good budget and use it in a positive way as a tool for budgetary control.

Leave a Reply