How To Prepare A Practical Budget?

Definition of Budget

Budget is a tool used by business as a guide, if it is prepared professionally, it can be a very powerful tool.

Budget is a business plan to enable the business to maximize the resource in order to achieve its plan or objective.

It is an estimation of revenue against the expenditure over a period.

What are the advantages of having a budget?

1. Having a clear business plan.

2. Act as a control of expenses.

3. Use as a benchmark to appraise the performance of the staffs.

4. Serve as an internal control feature for the organization.

5. Enable business to adjust and make changes when the deviation is too great.

1. Having a clear business plan

With budget, the business will have a clear direction in their business plan for the upcoming financial year.

Management can then plan their business plan based on the budget prepared.

After preparing a good budget, management can focus in achieving the target set.

2. Act as a control for expenses

after preparing the budget, the business can use that as a yardstick to ensure expenses are within the budgeted boundary.

Any deviation from budgeted amount will need to be investigated and action taken to rectify if it is human error.

3. Use a benchmark to appraise the performance of the staff.

Every year, business need to appraise the performance of the staffs.

To do that, the company needs to have some benchmark and barometer to assess the staffs’ performance.

Budget is a very good tool to appraise the staff performance, it is a more objective and transparent method.

Failure to achieve the target set in the budget, it leaves very little room for the staff to argue for his case.

Unless the budget prepared is unreasonable and unrealistic, then the staff may challenge the appraisal done.

If we prepare a very reasonable and realistic budget, this can be a very powerful budgetary control tool.

When it is used as the benchmark for staff appraisal, the targets are clear and not disputable.

4. Serve as internal control feature for the organization

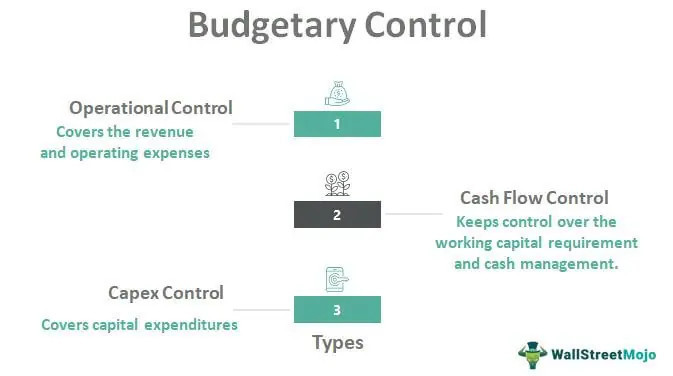

when one set up an internal control feature, one of the feature it can use is the budgetary control.

Frequent analytical review of the budgeted amount against the actual achieve, the management is able to use that to find out the flaws and the shortcoming in the operation of the company.

As an internal control feature, and through analytical review, we are able to see weaknesses in the operation and take necessary rectification actions if need be.

We can also use budgetary control to tighten the control especially on the expenditure, be it revenue expenditure or capital expenditure.

5. Enable the business to adjust and make changes when the deviation is too great.

Through monthly analytical review of the actual against the budget, the management is able to make the necessary adjustment.

Budget is not rigid, it may become not realistic due to the changes in business environment, changes in government policies or any event which is beyond the control of the business.

When this happens, management must at the first instance to revise the budget and adjust the business plan accordingly, if this is not done, then the budget may no longer become achievable.

If you are interested in how to prepare a good budget, you can purchase a copy of my lazypeopleguide e-book on this topic and gain some insight of it.

In my e-book, I will provide a comprehensive layout of the budget preparation and what you need to look for.

As usual my e-book is for those busy business persons who do not have the times to go through lengthy report and write up about how to prepare the budget.

It is a more practical guide, and it is easy to grasp the idea and concept.

If you want to learn more or wish to find out more in detail, you may contact me either using the contact form or drop me a message in my email.